Roth Maximum Income 2024

Roth Maximum Income 2024. For 2023, the roth 401(k) contribution limit is. Single and head of household.

Roth ira income and contribution limits for 2024. To max out your roth ira contribution in 2024, your income must be:

To Max Out Your Roth Ira Contribution In 2024, Your Income Must Be:

The roth ira income limits will increase in 2024.

For 2024, Maximum Roth Ira Contributions Are $7,000 Per Year, Or $8,000 Per Year If You Are 50 Or Older.

The same combined contribution limit applies to all of your roth and traditional iras.

Income Limit For A Full Roth Ira Contribution.

Images References :

Source: fancyqronnie.pages.dev

Source: fancyqronnie.pages.dev

Roth 2024 Limits Olly Rhianna, 12 rows if you file taxes as a single person, your modified adjusted gross income. Amount of roth ira contributions you can make.

Source: bunniqzaneta.pages.dev

Source: bunniqzaneta.pages.dev

401k And Roth Ira Contribution Limits 2024 Cammy Caressa, Roth contribution phases out entirely for income above. The roth ira contribution limit for 2023 is $6,500 for those under 50, and $7,500 for those 50 and older.

Source: ardythqhermione.pages.dev

Source: ardythqhermione.pages.dev

Roth Contribution Limits 2024 Minda Lianna, Roth contribution phases out entirely for income above. Amount of roth ira contributions you can make.

Source: topdollarinvestor.com

Source: topdollarinvestor.com

What Is a Backdoor Roth IRA Benefits and How to Convert Top Dollar, The roth ira income limits will increase in 2024. Contribution limits are enforced across traditional iras and roth iras, but income limits only apply to roth.

Source: choosegoldira.com

Source: choosegoldira.com

non working spouse ira contribution limits 2022 Choosing Your Gold IRA, Single and head of household. Less than $230,000 (married filing jointly) or less than $146,000 (single) reduced contribution.

Source: katharinewlusa.pages.dev

Source: katharinewlusa.pages.dev

Roth Ira Limits 2024 Nissa Estella, The maximum annual contribution for 2023 is $6,500, or $7,500 if you're. Roth contribution phases out entirely for income above.

Source: 2022jwg.blogspot.com

Source: 2022jwg.blogspot.com

What Is The Ira Contribution Limit For 2022 2022 JWG, The roth ira income limits will increase in 2024. 12 rows if you file taxes as a single person, your modified adjusted gross income.

Source: 2023bgh.blogspot.com

Source: 2023bgh.blogspot.com

Must Know 2023 Roth Ira Limits Article 2023 BGH, Single and head of household. For 2024, maximum roth ira contributions are $7,000 per year, or $8,000 per year if you are 50 or older.

Source: katharinewlusa.pages.dev

Source: katharinewlusa.pages.dev

Roth Ira Limits 2024 Nissa Estella, 2024 roth ira income limits standard contribution income limits: Single and head of household.

Source: skloff.com

Source: skloff.com

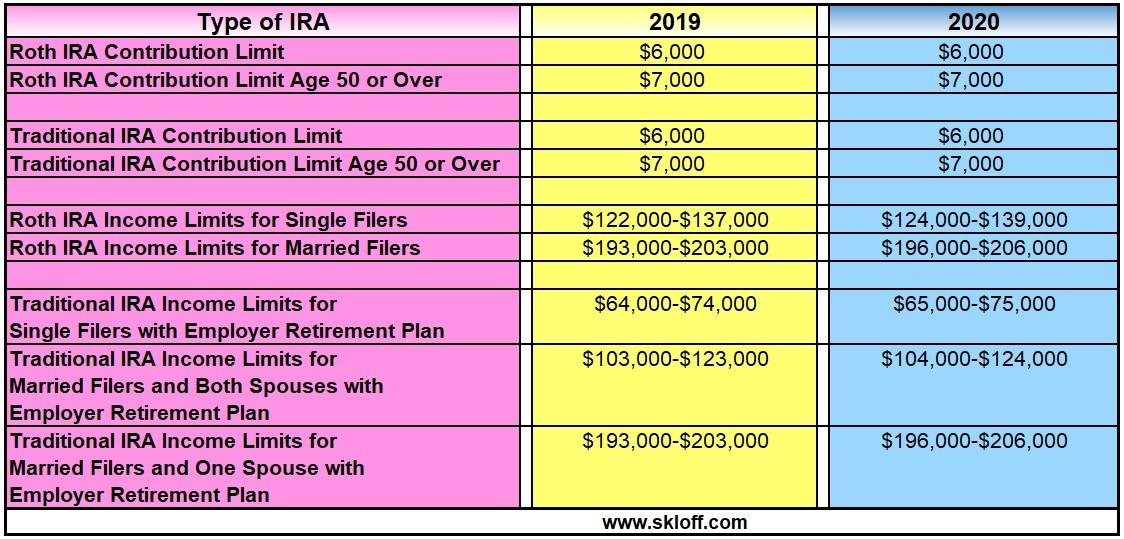

IRA Contribution and Limits for 2019 and 2020 Skloff Financial, Learn about the roth ira income limits for 2024, including updates and strategies for maximizing your contributions and retirement savings. Less than $230,000 if you are married filing jointly.

Roth Contribution Phases Out Entirely For Income Above.

For 2023, the maximum amount you can contribute to a roth ira is $6,500 ($7,000 in 2023).

Limits On Roth Ira Contributions Based On Modified Agi.

The combined annual contribution limit for roth and traditional iras for the 2024 tax year is $7,000, or $8,000 if you’re age 50 or older.