Fbar Filing Deadline 2024

Fbar Filing Deadline 2024

Check out our 2024 tax deadline calendars for businesses and individuals. The foreign bank account report (fbar) must be filed by april 15, 2024, with an automatic extension to october 15.

• how to file an fbar in 2024. Fbar deadline (fincen form 114).

Deadline To Pay Tax Due:

If you cannot file by the.

If You Meet Any Of The Following Guidelines, You Are.

But another vital tax deadline that frequently applies to taxpayers overseas or taxpayers in the u.s.

Images References :

Source: www.zrivo.com

Source: www.zrivo.com

FBAR Deadline 2023 2024, The deadline for filing the annual fbar. If you cannot file by the.

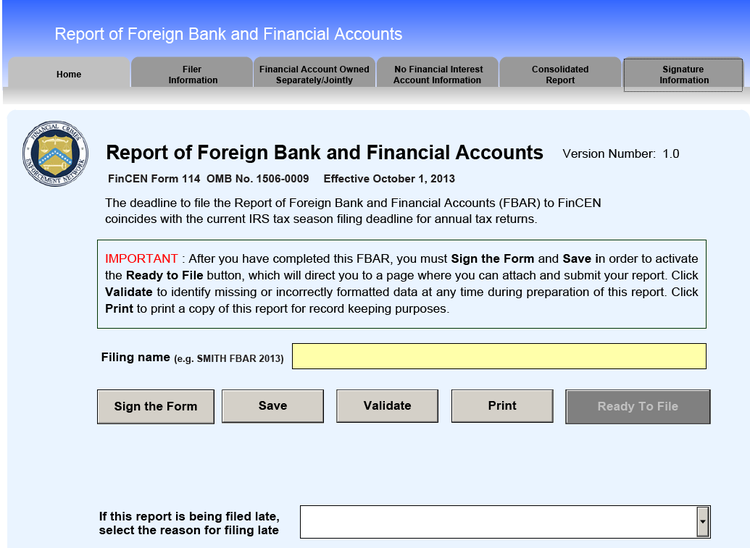

Source: gordonlaw.com

Source: gordonlaw.com

FBAR Filing Requirements 2024 Guide Gordon Law, The foreign bank account report (fbar) form falls in line with the typical us tax deadline: If you meet any of the following guidelines, you are.

Source: brighttax.com

Source: brighttax.com

FBAR Filing 2024 Clarifying FinCen Form 114 for Expats Bright!Tax, The foreign bank account report (fbar) form falls in line with the typical us tax deadline: The fbar 2023 deadline is the same as your income tax return due date, usually.

Source: www.fool.com

Source: www.fool.com

FBAR Filing Requirments 2024 What You Need to Know, Deadline to pay tax due: The bank secrecy act requires u.s.

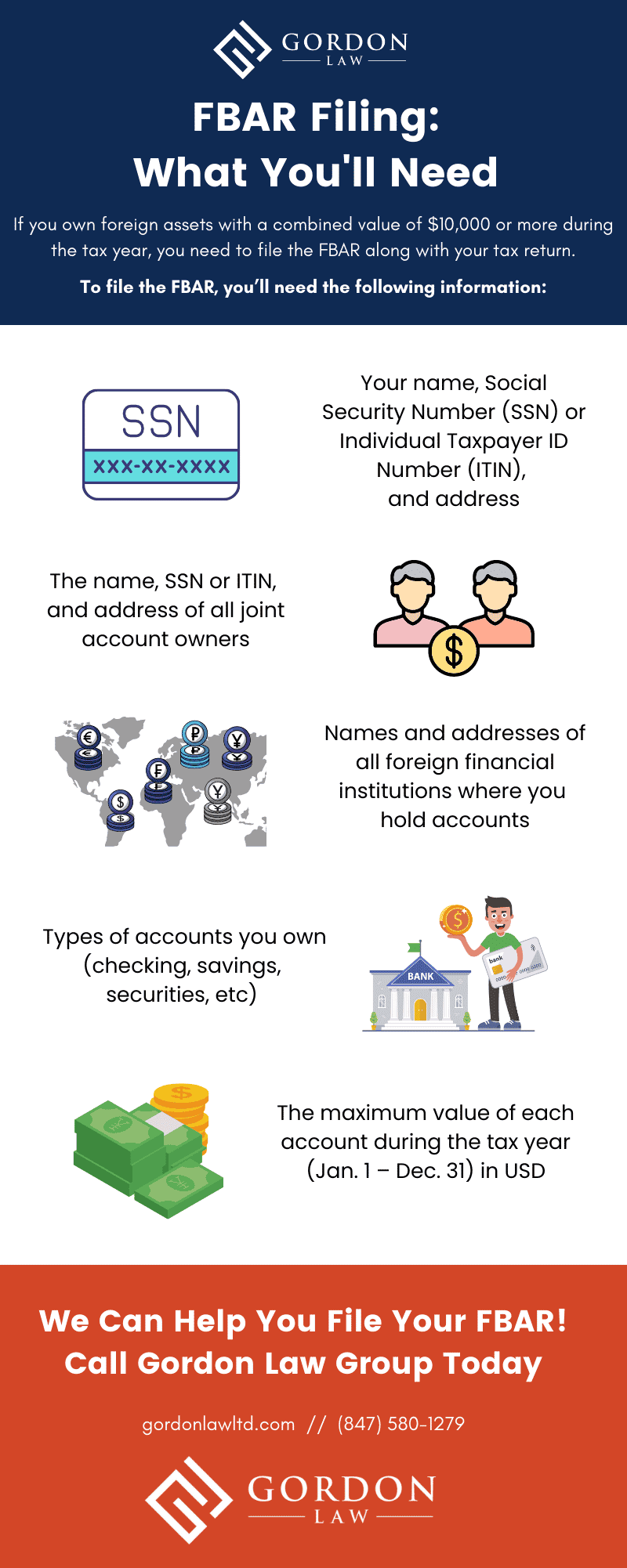

Source: gordonlawltd.com

Source: gordonlawltd.com

FBAR Filing Requirements A Simple Guide Gordon Law Group, The fbar is an annual filing and if you want to avoid penalties, make sure to file fincen form 114 by the due date. The standard deadline is april 15, but an automatic extension allows filings until october 15 without additional paperwork.

Source: www.youtube.com

Source: www.youtube.com

Are You Ready for the New 2024 Filing Requirements? FBAR & BOI, • what if i miss the fbar filing deadline? Missing this date can result in penalties up to inr 10,000 and interest on any tax due.

Source: www.myexpattaxes.com

Source: www.myexpattaxes.com

FBAR filing by the deadline. Secure & affordable. MyExpatFBAR, The federal tax filing deadline for the 2024 tax season passed (it was april 15 for most), but unfortunately, tax day isn’t the only deadline you need to know during the. As we approach the 2024 tax season, you must be mindful of us tax filing deadlines to organize yourself and avoid unnecessary penalties and interest for late or.

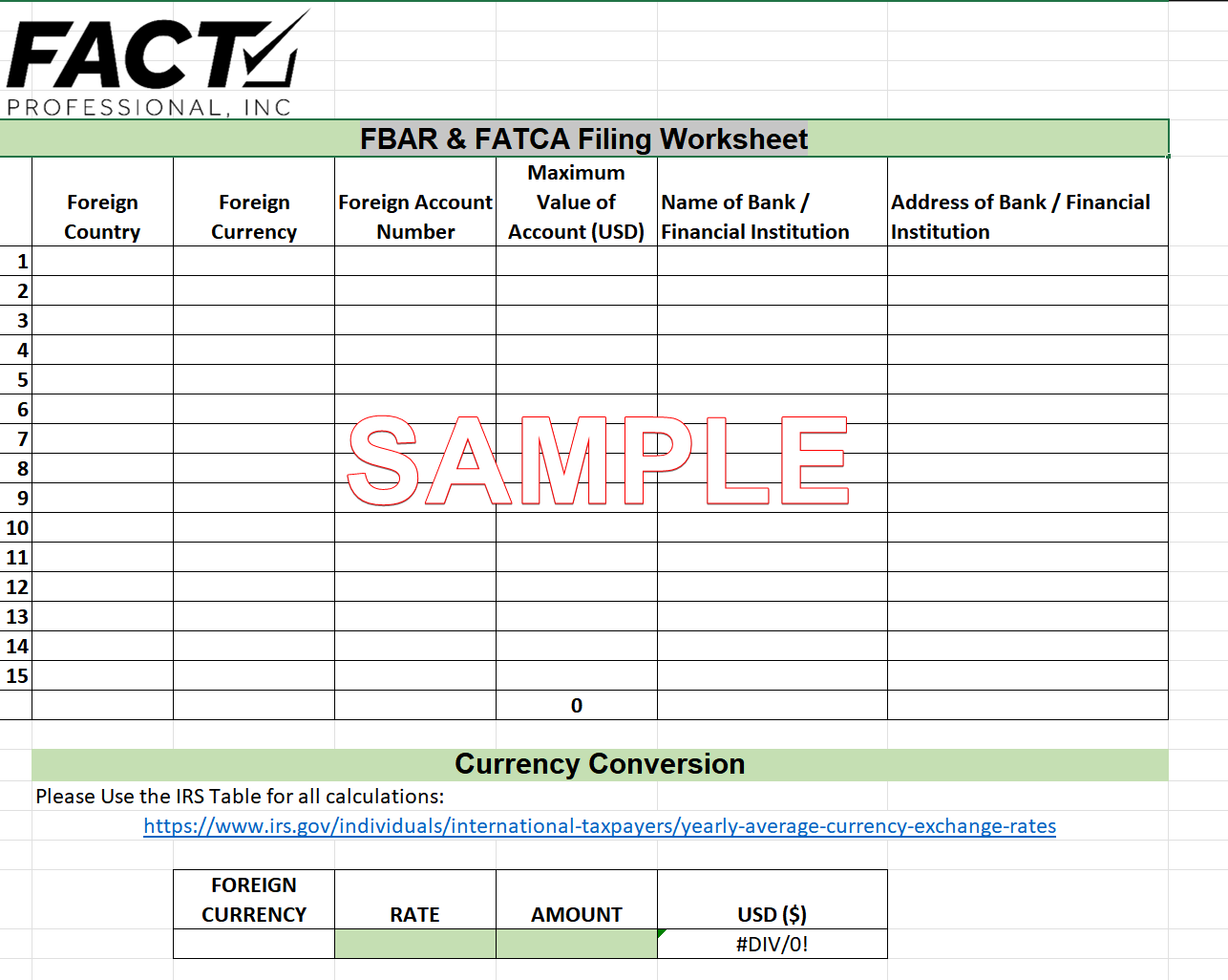

Source: factprofessional.com

Source: factprofessional.com

FBAR & FATCA Filing Worksheet Fact Professional, The foreign bank account report (fbar) form falls in line with the typical us tax deadline: Timely filing helps you avoid late fees, allows you to carry forward losses, and can speed up the processing of refunds.

Source: www.myexpattaxes.com

Source: www.myexpattaxes.com

FBAR filing by the deadline. Secure & affordable. MyExpatFBAR, The foreign bank account report (fbar) form falls in line with the typical us tax deadline: Fbar refers to fincen form 114, which was.

Source: www.youtube.com

Source: www.youtube.com

IRS reminds foreign bank and financial account holders the FBAR, The fbar must be filed by april 15, 2024. Fbar refers to fincen form 114, which was.

However, This Deadline Automatically Extends Two.

The bank secrecy act requires u.s.

Keep Detailed Financial Records For At Least Five Years And Consider.

The federal tax filing deadline for the 2024 tax season passed (it was april 15 for most), but unfortunately, tax day isn’t the only deadline you need to know during the.

Posted in 2024